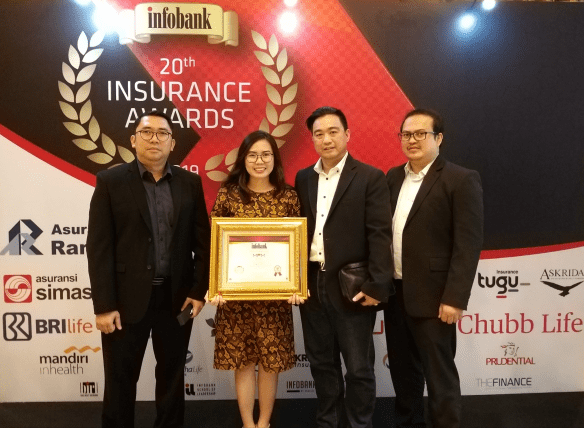

MPM Insurance Achieved “Very Good” Predicate version of Infobank

On Thursday (7/25/2019), Infobank Magazine presented awards to insurance companies during the “20th Infobank Insurance Awards 2019” at The Westin Hotel, Kuningan, Jakarta. The insurance companies are companies that have achieved the best performance in 2018, both life and general insurance. Based on the results of research conducted by the Infobank Research Bureau (birI), from 127 companies that were rated (74 general insurance and 53 life insurance), 40 general insurance companies and 13 life insurance companies managed to achieve the title of “Very Good”.

For general insurance, the range of values established by the Infobank Research Bureau is 0-50 classified as “Not Good”, 51-65 is classified as “Pretty Good”, 66-80 is classified as “Good”, and 81-100 is classified as “Very Good”. These values are obtained based on 10 rating criteria in 2019: (1) risk based capital (RBC) ratio, (2) liquidity ratio, (3) ratio of investment to current assets to total assets, (4) investment adequacy ratio, (5) ) growth in gross premium income and equity capital, (6) ratio of own retention premium to equity, (7) ratio of total expenses (claims, business, and commission) to net premium income, (8) ratio of underwriting results compared to net premiums, (9) balancing investment returns with net premium income, and (10) profit-loss ratio before tax compared to average equity and comprehensive profit (loss) ratio compared to average equity.

PT Asuransi Mitra Protectika Mustika (MPM Insurance) successfully won the “Infobank Insurance Awards 2019”. MPM Insurance was ranked top with a total score of 90.65% and was awarded the “Very Good” rating in “Rating 127 Insurance of the 2019 Infobank Version”, based on the category of general insurance companies with a gross profit of Rp 250 billion.

MPM Insurance’s business success in 2018 is reflected in its blue financial report cards, as seen from assets, investments, own capital, gross premiums and profits. From the data shown from the Infobank Research Bureau, MPM Insurance’s total assets in 2018 grew by 31.12% to Rp 1.03 trillion from the previous year. Likewise, the investment value grew 36.01% or increased by Rp 132.34 billion in 2018. In MPM Insurance’s financial data, gross premium income grew 24.02% from Rp 381.67 billion in 2017 to Rp 473.36 billion. While the profits earned by this company amounted to Rp 74.78 billion last year.

The positive performance obtained by PT Asuransi Mitra Pelindung Mustika is one of the results of the expansion of the office network. In 2017, MPM Insurance had 15 representative offices in Indonesia. In 2018, this general insurance company succeeded in adding 2 representative offices. This year, MPM Insurance plans to open two or three new branch offices in Sulawesi and Kalimantan.

This achievement is not only one of the milestones of MPM Insurance for its future success, but also as a boost to our enthusiasm to continue to fight for the entire family of this company, both internal and external parties.